As a freelancer or small business owner, you are your own boss, free to chart your own course. However, this independence also brings new responsibilities, particularly when it comes to your finances. One of the most significant shifts from traditional employment is handling your own taxes. Without an employer to withhold taxes from each paycheck, the responsibility for managing and paying your tax liability throughout the year falls squarely on your shoulders. This is where estimated taxes come into play.

For many, navigating the world of estimated taxes can be a source of confusion and anxiety, often leading to surprise tax bills and costly penalties. But it doesn’t have to be. Understanding your obligations is the first step toward financial clarity and compliance.

This guide will break down everything you need to know about estimated taxes, from who needs to pay them to how you can calculate and submit your payments on time. At O'Connor & Lyon, we believe that with the right knowledge, you can manage your tax obligations confidently and focus on what you do best: growing your business.

What Are Estimated Taxes and Who Needs to Pay?

The U.S. tax system is a "pay-as-you-go" system. For W-2 employees, this is handled automatically through payroll withholding. For the self-employed, the IRS requires you to pay taxes on your income as you earn it throughout the year. These payments are known as quarterly tax payments or estimated taxes.

You generally must pay estimated tax for the current year if both of the following apply:

1. You expect to owe at least $1,000 in tax for the current year after subtracting your withholding and refundable credits.

2. You expect your withholding and refundable credits to be less than the smaller of:

* 90% of the tax to be shown on your current year's tax return, or

* 100% of the tax shown on your prior year's tax return (or 110% if your adjusted gross income was more than $150,000).

This group typically includes:

* Independent contractors and freelancers

* Sole proprietors

* Partners in a partnership

* S-Corporation shareholders

* Individuals who receive other income not subject to withholding, such as dividends, interest, or rental income.

How to Calculate Your Estimated Tax Payments:

Calculating your estimated tax payments is the most challenging part of the process, but it can be broken down into manageable steps. Your payment needs to cover both your income tax and your self-employment taxes (Social Security and Medicare).

The official worksheet to help you with this calculation is IRS Form 1040-ES, Estimated Tax for Individuals.

Step 1: Estimate Your Annual Income

Start by projecting your total expected gross income for the year. If your income is stable, you can use last year's earnings as a baseline. If it fluctuates, you may need to adjust your forecast each quarter.

Step 2: Subtract Your Business Deductions

Next, estimate your total business deductions for the year. This includes expenses like home office costs, software subscriptions, supplies, marketing, and travel. Subtracting these from your gross income gives you your estimated net profit.

Step 3: Calculate Your Self-Employment Tax

This is a critical part of any self-employment tax guide. Self-employment tax is 15.3% on the first $168,600 (for 2024) of earnings, plus 2.9% on all earnings above that. This covers your contributions to Social Security and Medicare. You calculate this tax on 92.35% of your net self-employment earnings. You can also deduct one-half of your self-employment tax when calculating your adjusted gross income (AGI).

Step 4: Calculate Your Income Tax

Using your estimated AGI, calculate your expected income tax based on the current tax brackets. Don't forget to subtract any tax credits you expect to claim.

Adding your estimated self-employment tax and income tax together gives you your total estimated tax liability for the year. Simply divide this number by four to determine your quarterly payment amount.

Key Estimated Tax Deadlines You Can't Afford to Miss:

One of the most common mistakes is assuming "quarterly" payments align with the calendar quarters. They don’t. Missing these dates can result in penalties, so it's crucial to mark them on your calendar.

The estimated tax deadlines for income earned during a specific period are as follows:

* For income earned Jan 1 - Mar 31: Payment due April 15

* For income earned Apr 1 - May 31: Payment due June 15

* For income earned Jun 1 - Aug 31: Payment due September 15

* For income earned Sep 1 - Dec 31: Payment due January 15 of the following year

Note: If a due date falls on a weekend or holiday, the payment is due the next business day.

Understanding and Avoiding IRS Estimated Tax Penalties:

The IRS can charge penalties if you don't pay enough tax throughout the year, either through withholding or estimated tax payments, or if you pay late. The penalty for underpayment can be complex to calculate and adds an unnecessary financial burden to your business.

The best way to avoid IRS estimated tax penalties is to meet one of the "safe harbor" rules:

1. Pay at least 90% of your tax liability for the current year.

2. Pay at least 100% of the tax you owed for the previous year (or 110% if your AGI was over $150,000).

Meeting the second rule is often the simplest strategy, as it’s based on a known figure from your prior-year tax return.

How to Pay Estimated Taxes: Your Options

The IRS makes it easy to submit your payments. Here are the most common methods for how to pay estimated taxes:

* IRS Direct Pay: Make a secure payment directly from your checking or savings account for free.

* Debit Card, Credit Card, or Digital Wallet: Use one of the IRS's third-party payment processors. Be aware that these services charge a fee.

* Electronic Federal Tax Payment System (EFTPS): A free online service from the Treasury Department.

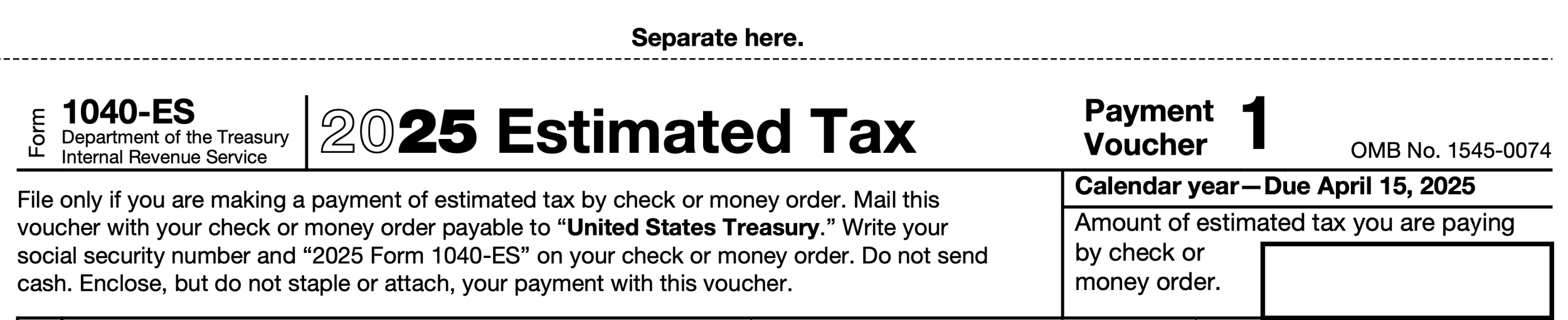

* Mail a Check or Money Order: Send your payment with a Form 1040-ES payment voucher to the address listed on the form instructions.

Partner with O'Connor & Lyon to Simplify Your Taxes:

Managing estimated taxes is a fundamental part of financial health for any freelancer or small business. While the process can seem daunting, staying organized and proactive is key to avoiding penalties and maintaining peace of mind.

However, you don't have to navigate these complexities alone. At O'Connor & Lyon, we specialize in providing comprehensive tax planning and preparation services tailored to the unique needs of self-employed professionals and small business owners. We can help you accurately forecast your income, identify all eligible deductions, and ensure your quarterly tax payments are calculated and filed correctly and on time.

Let our team of experienced professionals handle the details, so you can dedicate your time and energy to what truly matters—running your business.

Contact O'Connor & Lyon today for a consultation and discover how we can become your trusted partner in financial success.