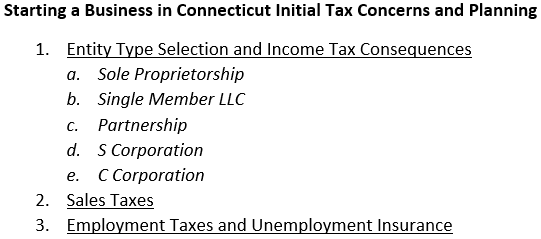

1. Entity Type Selection

First step in engaging in a new business venture is choosing the type of entity you want to open to conduct your business. This is not a simple decision and each of these business types could be spun off into a full blown lengthy article of its own, but I’m going to try to hit the highlights and stick exclusively to the tax consequences and concerns.

a. Sole Proprietorship

This is the default entity type. Failure to create an entity results in a classification as a sole proprietorship. If you just start doing business, whether it is as an independent contractor or entirely for yourself, you’ve become a sole proprietor. A sole proprietorship is an unincorporated business that is fully owned and operated by one person. All of the income tax reporting for a sole proprietorship is done directly on the individual’s annual 1040 on a schedule C. You have to include all of the income you receive on your Schedule C, but you can also include the business expenses to reduce that amount of income. You will ultimately be taxed on the difference between your income and your qualified business expenses (please note that not all expenses are deductible, generally expenses need to be ordinary and necessary for the business activity to be deductible). This income will be taxed as ordinary income at your marginal tax rate. You will also have to pay self-employment taxes on these amounts. The self-employment tax is a substitute for the Social Security and Medicare taxes that apply to earned income. For employees, these amounts are directly withheld/paid by employers but for any individuals that are generating earned income and are not employees, the self-employment tax needs to be paid. The self-employment tax rate is 15.3% and this is separate from and in addition to any income taxes that will need to be paid on this income. Note that you can take a deduction on Schedule 1 of your return for ½ of the self-employment tax paid. There are also some other potential deductions including the QBI deduction (for qualified business and services income with limitations), deductions for self-employed health insurance, and deductions for retirement plans funded via the self-employed activity. Note that the reporting that is required on Schedule C includes income and expense information but does not require balance sheet information.

Note that there is not a separate income tax return filing obligation for the sole proprietorship in Connecticut, and the income will be included on your Connecticut return via your federal Schedule C.

b. Single Member LLC

This is the entity type that results from the creation of a limited liability company that is owned by one individual. The income tax considerations for the Single Member LLC mirror the tax consequences of the sole proprietorship. Single member LLCs can elect to be taxed as S or C corporations, but by default they will be reported on the Schedule C of an individual’s 1040. This means that by default there won’t be any income tax return filing obligation for a single member LLC outside of the reporting done on an individual’s 1040.

c. Partnership

This is the default entity type for any business that has multiple owners/partners. If you engage in a joint venture with another individual and you don’t create an entity through the state for that business activity, then you have created a partnership. (Note that if your only business partner is your spouse, you may still be able to do the reporting on your jointly filed Schedule C of your 1040) Partnerships, unlike Single Member LLCs and Sole Proprietorships, require a separate informational filing with both the federal government and the state. This filing is done on Form 1065 and this filing is generally due on March 15th. This filing can be put on extension to September 15th, but you should note that all of the partners of the business will need the Form 1065 to be completed to enable them to prepare their current year personal tax returns. Partnerships, like sole proprietorships and single member LLCs, are pass-through entities. This means the partnership does not directly pay tax on their income, instead they complete an informational filing and the income passes through directly to the partners. Part of the preparation of Form 1065 includes the preparation of a K-1 for each partner. The K-1 will contain the items that an individual will need to accurately report the partnership income on their personal return. This reporting is done on Schedule E of your 1040. The income from your partnership that is active income relating to services provided to the business is subject to the self-employment taxes and self-employment deductions detailed in the sole proprietor section. Partnership filings do require additional informational reporting like balance sheet information (with some exceptions).

Partnership returns do require separate filings with the state of Connecticut on Form CT-1065. Connecticut, like many other states, has created a pass-through entity tax that imposes tax on the partnership and these taxes generate tax credits for the individual partners on their personal CT tax returns. The purpose of the passthrough entity tax is to provide the ability for individuals to deduct state tax payments as the federal 2018 tax reform imposed significant limitations on the amount of state taxes that are ultimately deductible. By imposing these taxes at the partnership level, the partnership is able to take a deduction for these amounts which directly lowers the income that passes through to the individual partners.

d. S Corporation

There are a number of different entity types that can become S Corporations for tax purposes. If you register with your state as a Corporation or an LLC you can make an election with the IRS to be treated as an S Corporation for tax purposes. To elect into S Corp treatment for your federal return you have to file an S Corp election on Form 2553. Note that some states, most notably NY, require a separate election to be made to be classified as an S Corporation for state purposes. Connecticut does not require a separate election.

Once classified as an S Corporation you will need to file a federal 1120-S and in Connecticut you will need to file a CT 1120-SI. S Corporation filings do require both income statement and balance sheet information (with some exceptions). S Corporations are also pass-through entities and require the preparation of K-1s for all of the shareholders. While the income from the S Corp passes directly through to the owners through K-1, S Corps are also required to pay a wage to their owners that are performing services for the company. This means that S Corps are required to jump through all of the hoops associated with having employees, doing the requisite withholding, and issuing W-2s to those employees. This results in owners receiving W-2s that have to be included as ordinary wage income on their 1040s, and also in K-1s that contain their share of the profits of the corporation. This has the effect of Social Security and Medicare Taxes being imposed on the wage component of their earnings but not on the profit component that passes through the K-1. It’s important to note that this wage requirement does give rise to the employment and unemployment tax reporting obligations detailed below in section 3.

e. C Corporation

C Corporation is the standard classification for corporations. C Corps are not pass through entities, and the C Corp tax returns are filed on Form 1120. C Corporations are directly subject to tax on the corporate income at the corporate income tax rates (currently 21%). Unlike S Corporations, C Corp owners are not required to receive a W-2 for the services that they provide to the C Corporation. Additionally, because the work for the C Corporation is not classified as self-employment income, you also do not have to pay self-employment tax on the income that is distributed from the C Corp to the shareholders. C Corps pass their income to shareholders via dividends (dividends which will generally be taxed at 15%). These dividends must be included on the individual shareholders’ Schedule B’s with their personal 1040s.

C Corps can, but are not required to, pay wages to owners that perform services for the corporation. These wages become a corporate expense that can be deducted by the corporation to reduce the corporate income, but these wages are also subject to all of the standard withholding (federal tax/state tax/Social Security tax/Medicare) and informational reporting (W-2), as well as the other reporting obligations discussed below in section 3.

C Corps also give individuals the ability to keep some corporate profits within the corporation to defer the tax that would be applied to the dividends at the individual level. However maintaining a retained earnings that is considered unreasonably large can result in the imposition of the accumulated earnings tax (an additional 20% of tax paid that can be applied when retained earnings is too large.)

2. Sales Taxes

When you open a new business, one of the important steps is determining whether that business will be subject to sales tax in your state. I’ll write a more detailed blog article on what is and what isn’t subject to the Connecticut sales tax in the future, but for now you should be aware that you may have to register with your state. If you are selling products or sales taxable services you must apply for a sales and use tax permit through the state. In CT most products and services have a sales tax of 6.35%.

In addition to paying your sales taxes, (either annually or monthly depending on the magnitude of your sales) you will have to begin filing the required sales tax returns. You should also keep in mind that you may have to register for sales tax permits in other states. You need to review the sales tax guidance for any state that you are physically conducting sales within, and you may also need to register, collect, and remit sales taxes for a state if you have economic nexus with that state. Economic nexus is a fancy way of saying that you are doing enough business in that state that you’re considered to have a presence there (even if you never go into that state or conduct any business within that state). The threshold typically applied for economic nexus with other states has changed somewhat recently with the South Dakota v. Wayfair decision in 2018. Specific state rules may vary but generally you will be considered to have economic nexus if you have more than 200 sales transactions into the state or if you sell over $100,000 of goods/services into the state.

3. Employment Taxes

If it’s not enough that you’ve had to register your business with the state, needed to register separately with the state (and maybe multiple states) for sales and use taxes, you also need to be aware that there is a separate registration and there are separate filing obligations if you have any employees.

If you have employees you need to alert the state Department of Revenue and make sure that you are doing all of the proper withholding for those employees. The required withholding includes the federal taxes, state income taxes, Social Security taxes, and Medicare taxes. Note that the employer has to pay half of the FICA taxes(Social Security and Medicare) and the other half is paid by the employee via withholding that the employer needs to setup for each employee. Additionally you have to register with the state Department of Labor and need to pay in unemployment and worker’s compensation taxes for your employees. The unemployment insurance taxes are entirely separate from the income tax amounts associated with the wages your employees are paid.

You also have to remember that you have to pay federal unemployment taxes as well.

The Connecticut unemployment insurance taxes need to be filed and paid quarterly.

Many businesses hire payroll companies to assist their businesses with all of these filing obligations that arise from the business having employees.

We’ve now covered a brief overview of the tax filing obligations applicable to businesses operating in Connecticut. The type of entity that you create will dictate the tax return filing obligations. The type of goods you sell or services you provide will dictate the applicability of the state sales tax. And whether or not you have employees will determine if you need to setup the applicable accounts with the state and the federal government to handle the tax withholding and the unemployment insurance related payments.

If you are thinking about starting a business in Connecticut and would like to discuss some of these filing obligations that will arise from that business, feel free to reach out to schedule a consultation. We can provide guidance on what entity type might best suit your business for tax purposes and at the very least we should be able to appropriately set your expectations for the amount of time, effort, and money that is involved with handling all of these filing obligations.