Let’s start by taking a deep breath. This can be a pretty intimidating letter to receive in the mail but it doesn’t mean that you won’t be able to find an avenue to come into compliance that will minimize the amount of potential harm.

Remember, time is a factor in responding to this letter. Do not put off investigating the issues and bringing professionals on board to assist you as needed.

What is a 6185 Letter?

The 6185 is a letter that the IRS sends out when they believe that you have an interest in a foreign account, foreign asset, or foreign entity (corporation, partnership, retirement plan, trust etc) that you didn’t accurately disclose on your U.S. tax filings.

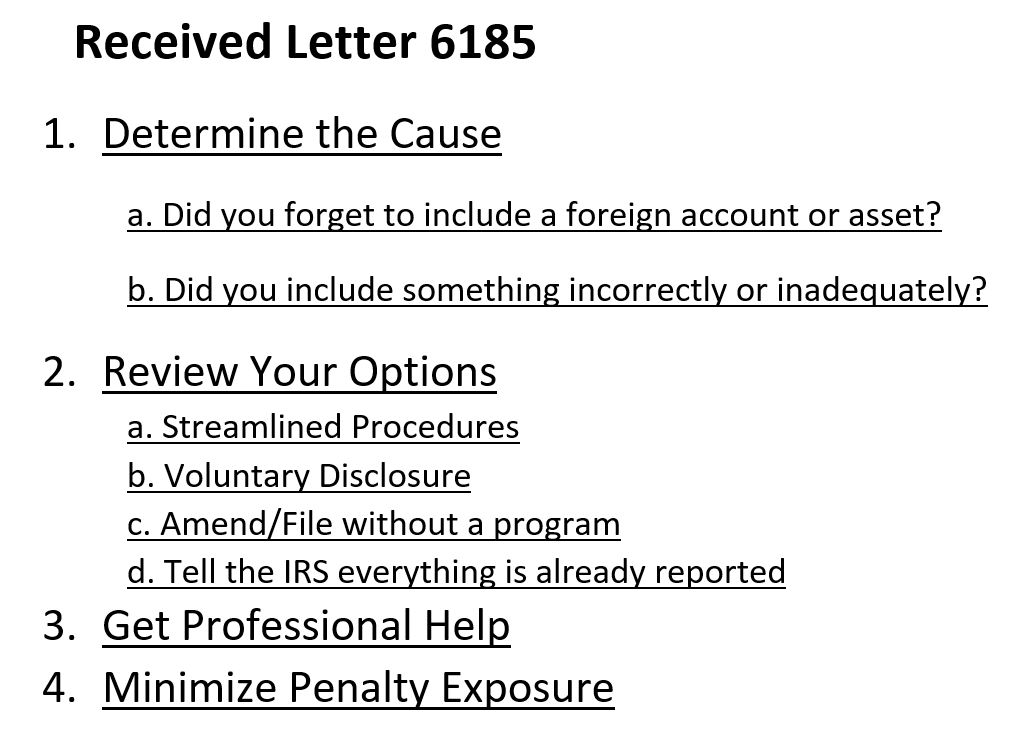

What to do?

Realistically, the first thing you should do is pick up the phone and call me, someone like me, or better still, a few different professionals for free consultations. These letters come with a deadline for a response, and if a full disclosure is required, every day between your receipt of that letter and that due date may be required to accurately create your disclosure. This is a time sensitive issue and you should not hesitate to begin addressing it. Not to mention the fact that sometimes these letters aren’t received until just a few days before a response is required. You are able to obtain extensions to respond to this letter and the IRS is consistent and prompt in responding to all inquiries to this hotline: 1(267)466-0020 (but do check the phone number on the letter you received as IRS’ phone numbers are subject to change, although this has been the OVDP Hotline for many years).

Find the error or omission

Determining what has been omitted from your U.S. tax filings can be a very difficult process. Sometimes individuals have entirely omitted an asset and other times they have just disclosed it improperly enough that a review of their tax filings may create the impression that the asset hasn’t been disclosed.

This can boil down to an issue of fact (i.e. you forgot to include one of your accounts) or an issue of tax law (you included everything but may have done the reporting incorrectly or inadequately.)

You are probably the best person to review all of the foreign accounts/assets/entities that you have an interest in or signatory authority over. Think back through your life and try to identify all of the accounts that you’ve ever opened, looking for any that may have been omitted from your FBAR, Form 1040, or Form 8938. It’s unfortunate that you are only ‘probably’ the best person to perform this review, as it is very common in some countries for family members to open accounts in relatives’ names. I have assisted many individuals with disclosures who were entirely unaware of a significant number of accounts that were opened in their name. Unless you are absolutely certain that this isn’t the case for you, you should reach out to any family members that may have opened an account in your name, and ask them to think back through the years to recall whether they opened any accounts for you or in your name. Be sure to explain the importance of the question, as most foreign individuals will not appreciate the fact that the U.S. imposes substantial penalties for tax noncompliance.

Hopefully this review will give you a rough idea regarding what has been omitted from your filings, but if it doesn’t, it could be that it’s an issue of law and the real issue is how improperly some things have been reported. This is something that a tax professional should be able to help you identify.

What are your options?

The 6185 outlines a handful of options for you, including 1. A Streamlined Disclosure; 2. A voluntary disclosure; 3. Filing delinquent or amended returns; 4. Explain that you’re already in compliance.

A STREAMLINED DISCLOSURE

For individuals that have made mistakes or omissions with their tax filings who did not make those errors willfully, the Streamlined Domestic/Foreign Offshore Procedures are normally the most favorable option. SDOP will apply a 5% penalty to the noncompliant accounts and SFOP (for individuals with a qualifying year of non-residency) has a 0% penalty. You can read more details about the streamlined domestic procedures from my blog here, the streamlined foreign procedures from my blog here, or from the IRS resources: https://www.irs.gov/individuals/international-taxpayers/streamlined-filing-compliance-procedures. The short overview is that this disclosure requires 6 years of amended/delinquent FBARs to be filed, 3 years of amended returns (you are only eligible for this program with delinquent returns if meet the non-residency requirement for SFOP), and a non-willful certification explaining all the facts and circumstances that resulted in your omission.

2. A VOLUNTARY DISCLOSURE

The voluntary disclosure program is generally for individuals that have deliberately hidden assets or underreported their assets and/or income who want to try to avoid any potential criminal prosecution for their actions. The terms of the voluntary disclosure program are much much worse than the terms of the streamlined programs. This program requires you to first go through a preclearance for your eligibility and to confirm that that you are not already under criminal investigation. The submission for this program requires 6 years of FBARs AND 6 years of tax returns. You can read more about this program in a separate blog article here: OVDP's Successor: IRS Criminal Investigation Voluntary Disclosure Practice

3. Filing Delinquent or Amended Returns

The third option of filing delinquent or amended returns is for individuals who didn’t commit tax crimes, and who are outside of the streamlined compliance procedures. Generally the Streamlined procedures are going to be the most beneficial way to come back into compliance (for eligible individuals) but this isn’t necessarily always going to be true. You should always review and compare your penalty exposure through the streamlined program to your penalty exposure when filing the delinquent//amended returns. There are some important considerations to keep in mind when comparing these two options. First, the streamlined procedures generally capture the most recent three years of tax returns while just filing amended or delinquent returns can possibly extend much further back than three years. When a return is unfiled, the IRS is not limited in their ability to make an income tax assessment against that return. You should also keep in mind that the 5% miscellaneous offshore penalty associated with the streamlined disclosure is a replacement for all other possible penalties, and there are quite a few different applicable penalties (FBAR penalties, informational penalties on forms like 8938, 5471, etc, late payment penalties, late filing penalties, accuracy related penalties (which are increased to 40% for unreported foreign assets). This 5% penalty also only applies once whereas the penalties that can be applied to delinquent or amended returns can be applied to each year.

4. Explain That You’re Already in Compliance

The fourth option is responding to the letter to explain that you believe you’re fully in compliance with your reporting obligations. Now, obviously you should only use this option if you have scoured your memory and your records and fully believe that you are in compliance with your reporting obligations, but, keep in mind that the IRS didn’t send you this letter in an attempt to fish for unreported assets, they received some information from another source that has led them to believe that you haven’t reported all of your assets. It’s possible that this is in error, but before you take that position, potentially forfeiting your ability to use the streamlined procedures, take the time to thoroughly review your situation to confirm that you are already in compliance.

Get help!

If you receive this letter there is a good chance that you’ve made some mistakes with your filings. Trying to resolve these mistakes on your own can result in some exorbitant penalties. I can’t stress enough the importance of reaching out to tax professionals to assist you with correcting any mistakes you’ve made that involve foreign assets or foreign accounts. The penalties are too substantial to try to resolve this on your own, and I have seen instances where taxpayers, acting in good faith, trying to correct their mistakes themselves, have had penalties imposed on their amendments because they did not properly utilize the available IRS procedures and programs. Don’t make this mistake, especially when you’re a free consultation away from having a better understanding of the scope of your issue.