The Law Offices of O'Connor & Lyon is

a full service law firm specializing in

domestic and international tax matters.

Phone: (203) 290-1672

The Law Offices of O'Connor & Lyon is

a full service law firm specializing in

domestic and international tax matters.

Phone: (203) 290-1672

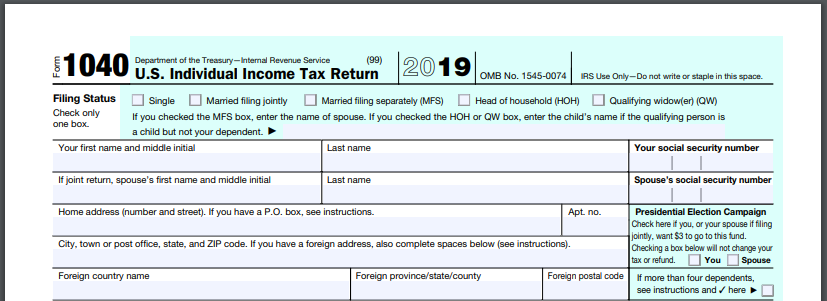

Attorney prepared tax returns billed at tax preparer rates. We are experienced in preparing and reviewing some of the most sophisticated personal and business tax filings. When you hire us to prepare your return, rest assured that you will receive top tier service.

We can accommodate your tax preparation goals whether you want to understand the ins and outs of the schedules on your tax return or simply have the return prepared as efficiently as possible.

With years of experience testing a variety of tax preparation programs, O’Connor and Lyon utilizes CCH Prosystem fx Tax, as it is head and shoulders the most efficient and robust tax preparation tool available to tax professionals.

Document exchange is the lynchpin of tax preparation. Our document exchange will keep a log of the documents you’ve already provided on the client and the attorney side of the exchange. Between our tax questionaires and our document exchange, you can be confident that you’ve provided all the documentation that we require to prepare a complete and accurate return.

O’Connor & Lyon

Global, Audit-Ready Tax Preparation

The records utilized in preparation of your tax returns are maintained and all returns are audit ready. We also offer to prepare page numbered review packets that provide detailed overviews of tying the source documentation to the returns.

We assist clients living around the world in filing their U.S. tax filings and any associated state tax filings. With O’Connor and Lyon you can move forward confidently with your tax preparation knowing that none of the work will be outsourced, and that we stand behind every attorney prepared return.

O’Connor & Lyon is well versed in the preparation of the most complicated international forms, including: Form 5471 (Foreign Corporations), Form 3520 and Form 3520-A (Foreign Trusts and Foreign Retirement Plans), Form 8854 (Expatriation), Form 8858 (Foreign Disregarded Entities), Form 8865 (Foreign Partnerships), Form 8621 (PFICs i.e. Foreign Mutual Funds), FBARs (Report of Foreign Bank and Financial Accounts), Form 8938 (Statement of Specified Foreign Financial Assets), and all of the other reporting obligations applicable to international individuals.

Whether your return is a straight-forward W-2 return or you have a host of businesses, trusts, rental properties, RSUs, ESPPs, ESOPs, QBI applicable investments, capital gains transactions, etc we are well situated to prepare accurately prepare your federal and state tax returns. The easier the return, the quicker the preparation, the less the cost.