The Law Offices of O'Connor & Lyon is

a full service law firm specializing in

domestic and international tax matters.

Phone: (203) 290-1672

The Law Offices of O'Connor & Lyon is

a full service law firm specializing in

domestic and international tax matters.

Phone: (203) 290-1672

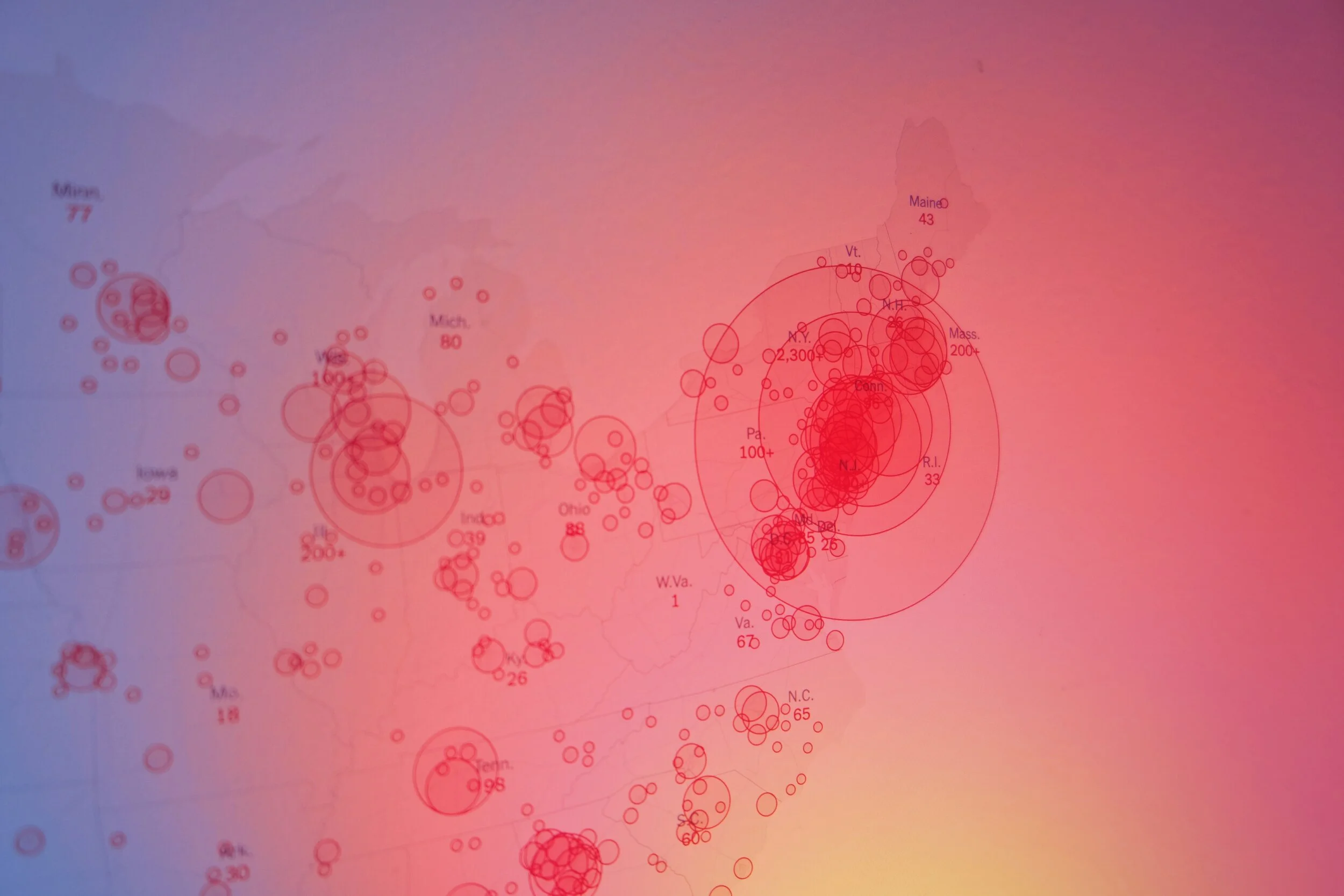

Our Practice During Covid-19

We are routinely working remotely with our clients around the world, and we are well situated to continue working business-as-usual through this pandemic. We primarily interact with our clients via phone, e-mail, SMS, and our secure document exchange. When you work with us, you shouldn’t expect any Covid related delays to our correspondence, our work on your case, or our work on your tax returns.

The IRS is still behind due to Covid related delays, but they are up and running and beginning to work through their backlog. They are transitioning more and more employees to working remotely, allowing them to pursue individuals with the same pre-Covid vigor. With the IRS resuming their collection and audit activities, you can’t afford representation that can’t work promptly and consistently to help you weather your IRS issues or act quickly to help you move on tax related issues before the IRS reaches out to you.