This line captures all of your interest income.

If you have a savings account, there is a reasonably good chance that you have interest income. For a typical savings account you will aggregate the interest payments from the entire year and include this amount on Line 2. You report the gross amount of interest paid to you, you cannot reduce this amount by any bank fees. This line should include interest amounts as low as $1, bearing in mind that 50 cents rounds up to $1.

Interest is not only generated from savings accounts. Some checking and current accounts generate interest. If you are unsure if a particular account is interest bearing, be sure to check your statements to determine if there are any interest deposits from a particular account.

The IRS may even pay you interest on a refund. The IRS tracks each tax year for each taxpayer as a separate account and depending on your circumstances, they may pay you interest based on refunds that they owed you. This interest is taxable and must be included on Line 2 as well.

Money market accounts are another example of an interest bearing account. These are typically accounts that have higher interest rates than savings accounts but some restrictions on account maintenance/activity.

Domestic Money market funds are another example of an account that can generate reportable interest. These are typically funds that have a static share price (i.e. $1 per share) and invest in a variety of interest bearing vehicles. Some of the interest generated by a money market fund may flow from underlying investments in government bonds that are more favorably taxed.

Certificates of deposit (CDs) are investment products that generate interest too. When you open a CD you commit to keeping your money locked into the CD for a fixed amount of time in exchange for an interest rate that should be better than the comparable savings account interest rates. You effectively exchange the ability to use your money for a set amount of time for a small bump to the available interest rates.

Loans are another interest generating vehicle. If you loan money to someone (even if that person is a close friend or family member) there is an expectation that that individual will pay interest on that loan. For the IRS to respect a transaction as a loan (as opposed to a gift) you need to check a couple of boxes, one of those boxes is the agreement to have interest paid on that loan (there are federally set base interest rates called the Applicable federal Rates (AFR)). The interest that is paid to you by someone that you’ve loaned money to must also be captured on line 2 of your 1040.

Interest can flow through to you from your ownership or partial ownership of an S-corporation or a partnership. One example would be an investment in a publicly traded partnership (PTP) that is classified as a Master-Limited Partnership (MLP). When the partnership does their yearly reporting and provides you with a K-1 for your interest in the partnership, you will include any interest on the K-1 on your Schedule E reporting (a more detailed review of schedule E coming soon) and it will flow through to your Schedule B (the form which captures your interest and flows the information through to line 2 of your 1040).

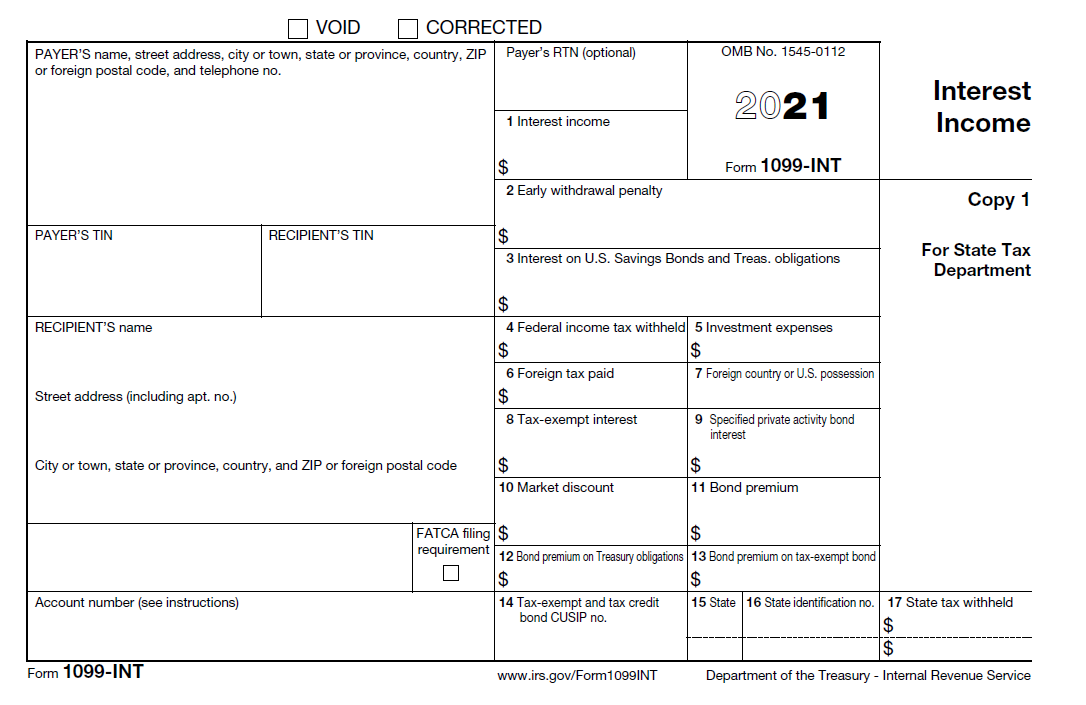

Generally interest will be reported to you on a 1099-INT. There are filing thresholds for these forms, so it is possible that the amount of interest you earned in any particular account is below the threshold that requires the financial institution to file a 1099-INT. Aside from the 1099-INT and the K-1, another common form that will be provided to you to report interest amounts is the 1099-OID (some CDs will provide 1099-OIDs). We’ll hit on OID a little more thoroughly in the international corner below, but you should be aware that interest amounts on a 1099-OID do need to be included on line 2 of your 1040.

International Corner

Your foreign interest is always included on line 2 as well. There are quite a few foreign investments that require you to OID the interest. OID stands for original issue discount and I will occasionally use OID as a verb, as above, to indicate that you must treat a particular item of interest in the same fashion as interest reported to you on a 1099-OID. To OID interest means you must allocate the interest amounts to the years during which that interest is accruing. You have to OID interest in fixed deposits and CDs that have terms that are longer than a year and that don’t pay the interest until completion of the term.

To provide a straightforward example, let’s assume that you have a 200,000 rupee fixed deposit in India that you opened on January 1st 2019 and that will pay out on December 31st 2020 with 14% interest (effectively 7% per year). You must allocate the 28,000 rupees of interest to both 2019 and 2020 based on the number of days the investment was held during those years. Even though the interest won’t be paid until December 31st 2020, you still need to include 14,000 rupees of interest on your 2019 return. Because this is an income item accruing over the course of 2019, we will use the IRS average annual exchange rate for 2019 (70.394) to convert the 14,000 rupees into $199. This $199 will be included on your Schedule B and on line 2 of your 2019 1040.

It is also worth mentioning that if you have a foreign money market fund or a foreign bond fund, the income associated with these investments WILL NOT be treated as interest. Foreign funds (including mutual funds, bond funds, and money market funds) are classified as passive foreign investment companies (PFICs) and are one of the most tax disadvantaged investments that you can own. See this article on PFICs for more detail regarding how these investments must be reported and taxed on your U.S. tax filings: PFIC Overview: Form 8621 Tax Consequences